Welcome to Lost In The Exchange - The essential FX newsletter to keep you informed and prepared for the week ahead.

Note: we have made some changes to our business, and no longer are active in the Discord group. There are many reasons for this but the focus will now be on this newsletter and we will introduce a paid subs section fore more detailed analysis going forward.

Additionally, when we surpass 10k subs, we will issue a minimum of 2 copies per week, share around your friends and keep an eye for referral programmes.

In this weeks copy:

Big news is past, whats next for markets?

US policy decisions likely to cause a waiting period

XAUUSD bears look set to challenge $2600 again

After a huge week of data, what do markets look like for the rest of 2024.

The wait is over, and Trump is back in. As a result we seen some heavy outflow in Gold, and into DXY and Equities.

The markets will now be awaiting Trump’s economic policy to confirm sentiment into 2025, however expectation is for extended tax reliefs and spending for business, boosting economic growth and given the bulls sustained reasoning.

The concern at this stage, is the ever rising deficit the US is racking up, with the CRFB’s estimate of an additional $7.75 trillion in debt, over a 10 year period from 2026. Additionally, the impact of increased tariffs from Trump may trigger a rise in inflation during 2025 weighing on markets.

As usual, the announcements from the FED continue to indicate a data driven approach, albeit a market expectation of the funds rate to be 3-3.25% by the end of next year, it will ultimately be at the mercy of Trump’s policy decisions as to how they respond.

Rate cuts rather muted in the shadow of elections

We have seen further rate cuts as expected from the FED this week, taking the funds rate down to 4.75%, but not causing much movement in the DXY crosses at all.

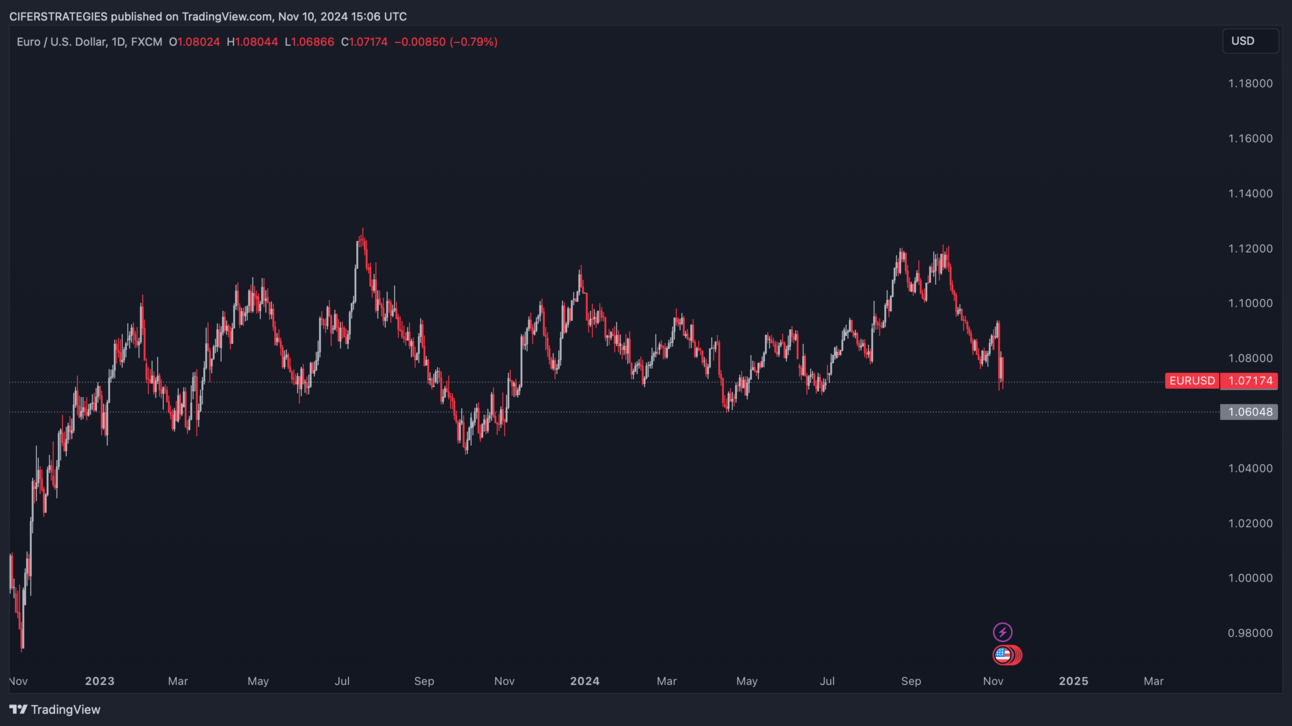

DXY continues to push on taking the majors lower, with EURUSD now down 500 pips from the September 30th highs. In just five weeks, we’ve seen significant inflows into the DXY, alongside an extended decline in PPI figures from Europe’s largest economy, Germany, putting pressure on EURO.

The main driver shaping this pair is the divergence in central bank policies between the US & Eurozone. The ECB has taken a much more dovish stance among driven from poor data indicating sluggish economic growth.

However, the market has ran on quite considerably therefore we must remain open to larger market rebalancing, in the form of some weakness in DXY. Whether it is sustained for prolonged periods depends on incoming factors, but personally I remain cautious at these lows with expectations of a slow down in bearish movement around 1.0600.

Any shorts would be intraday only as I see it rather unlikely to keep printing high volume bearish candles at these levels.

Key support range from 1.0600 - 1.0700, rather wide I know, however we would need some strong bearish momentum to take this out and breaking down from this nearly 2 year range.

EURUSD daily back at range support

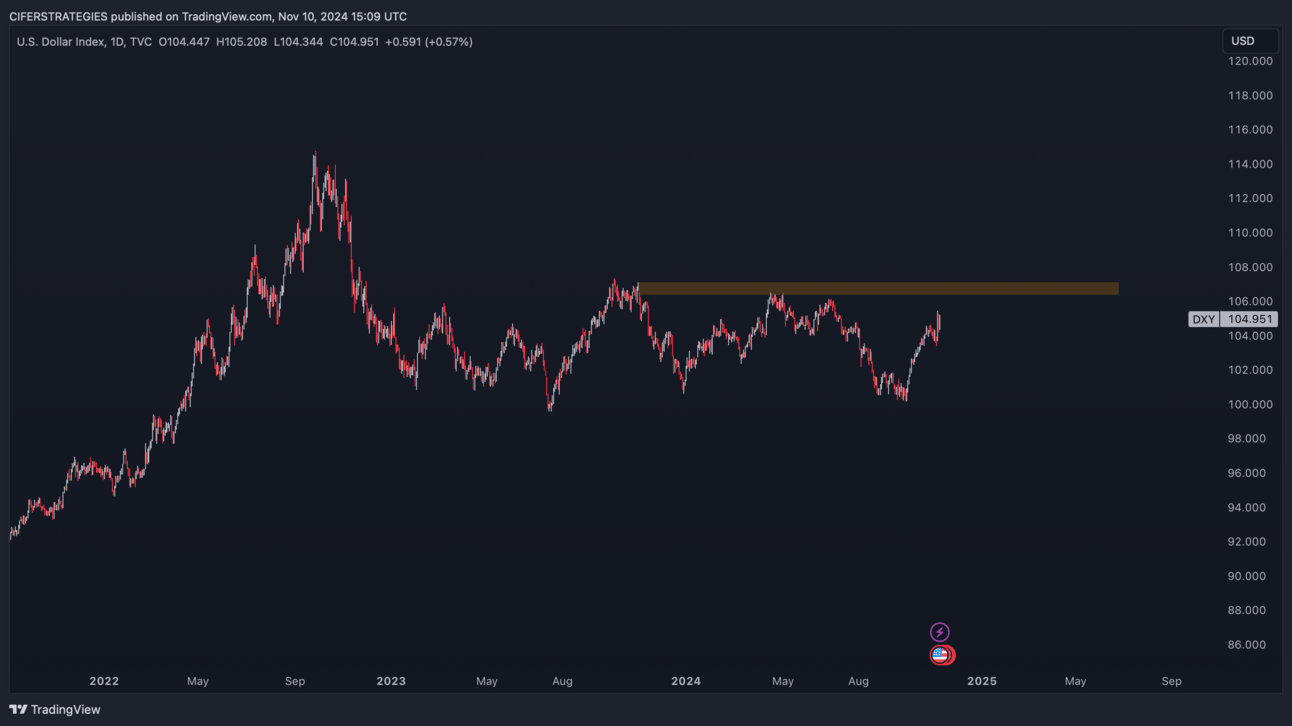

DXY daily

The USD index (DXY), is also approaching some range highs, where we are likely to see some profit taking.

I won’t aim to look far in to the future, until Trumps policies are clearer, and we know the expected impact of tax and tariff changes.

XAUUSD idea for the coming weeks

I anticipate further bearish movement on XAUUSD to take hold back towards $2600, perhaps this week or into next week.

I always remain open to market movements and adapt accordingly. If bulls take control to challenge the highs once again, I would be cautious shorting.

However, we have seen a clear snap and profit taking occur post election, with clear support around $2600 I expect the market to challenge from a technical perspective.

‘The Traders Diary’ pre launch discount

I am excited to announce the launch in the coming weeks of The Traders Diary.

This is based and built on my own personal journalling, with my own personal macro biases, trade journal, clear prop firm management guide all built out via notion.

The sale copy will have up to date macro analysis on GBP, USD, JPY and EURO, also the most recent trades taken and given via my discord and journaled those missed opportunities for future references.

In my opinion, this is a complete template any trader needs to thrive.

Here is a sneak peak at the uncompleted template, however this will be available for pre launch at a discounted 25% off.

When this is finished and released next week, there will no be future discounts.

I strongly believe using templates like this helps keeps discipline and focus into what we as traders are looking for in the market, and identify errors and patterns along the way.

Front page template

Learn more in detail and pre order now at this link: https://digieconomy.gumroad.com/l/gljsb

Funding and Software; Tools of the trade

Here are the tool I use to and funding companies I trust:

Futures charting software

Sierra charts

Live order routing is with Stage 5

Custom calibrated Futures charts

Personal Brokers:

IC markets

XM Markets

Funding

FTMO

E8 Funding

Have a great week everyone.